Connecting Technology, Businesses and Financial Services: Singapore’s First Inclusive One-Stop Platform Spearheading Sustainability

Connecting Technology, Businesses and Financial Services: Singapore’s First Inclusive One-Stop Platform Spearheading Sustainability

- Sustainability Platform Connecting Corporates of all sizes with Accessible Carbon Tracking Solutions and Green Financial Services

- Founded by Three Homegrown Technology Companies Specialising in Internet of Things (IoT), Data Analytics and Blockchain

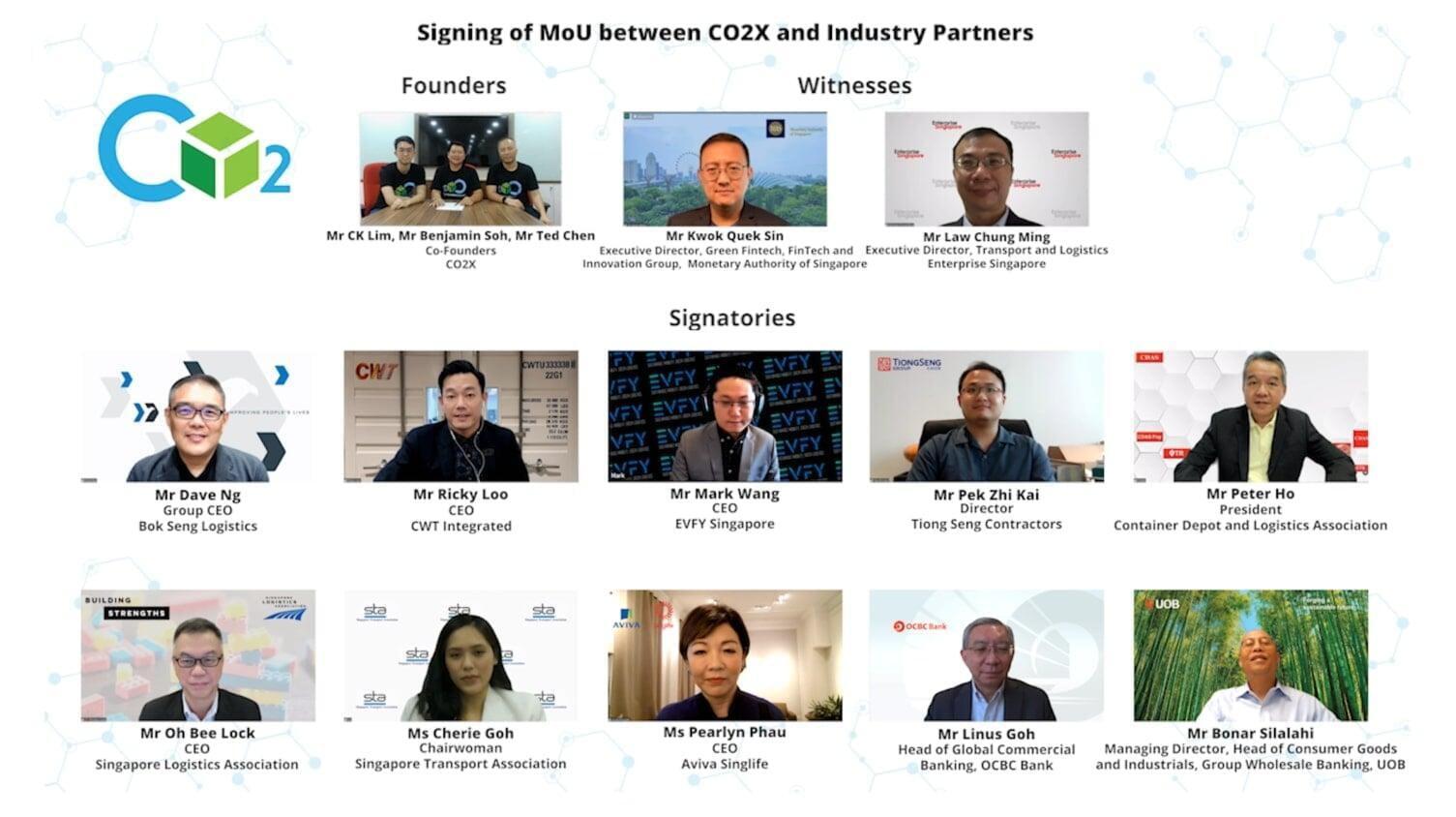

- Memorandum of Understanding (MoUs) Signed with Key Representatives from the Transport and Logistics Industry Corporates and Financial Institutions to Kickstart the Beta Phase

Singapore, 15 October 2021

Fig 1: Screenshot of participants from MoU signing

CO2X is a company founded by 3 homegrown technology companies, Ascent Solutions Pte Ltd (“Ascent”), Evercomm Singapore Pte Ltd (“Evercomm”) and multi-award-winning FinTech firm, Hashstacs Pte Ltd (“STACS”), known for their innovative solutions. The partnership was formed following the participation by Ascent Solutions and Evercomm Singapore in ESG’s Scale-up SG1 programme.

CO2X was set up to achieve the sustainability aspirations of the Founders through their respective expertise in emerging technologies such as the Internet of Things (IoT), Data Analytics and Blockchain. The CO2X platform leverages these technologies to help businesses and the financial sector navigate the complex regulatory and costly certification frameworks that hinder the adoption and financing of sustainability practices, especially for SMEs.

Leveraging on the CO2X platform, companies are able to track their carbon footprint to achieve benchmarking and devise data-driven emission reduction strategies that in turn help reduce the fuel and energy costs of doing business. They can also use the data and reports offered by CO2X to undergo green certification against international standards. CO2X also goes one step further to attract green financial services like sustainability-linked loans and insurance products through the issuance of certified carbon avoidance certificates captured on the blockchain. Financial service providers like OCBC, UOB and Aviva Singlife have also joined the MoU signing with CO2X to explore this further.

CO2X will begin testing its beta platform in November 2021 with key industry partners including Bok Seng, Chuan Lim Construction, CWT, EVFY, FoodXervices, Tiong Seng, and Contractors. CO2X has strategically chosen to focus on the Transport and Logistics sector as it contributes to 14.8% of Singapore’s carbon emissions2, making it the third largest polluting sector in the nation. While initially focusing on the Transport and Logistics sector, CO2X aims to expand its offering in the future to other sectors such as construction, manufacturing, hospitality and facilities management given the adaptability of the platform.

Mr Lim Chee Kean, Chairman and Co-founder of CO2X, and the CEO of Ascent, commented:

“Sustainability is an increasingly important and necessary strategy for all companies, across all industries, to stay competitive today. Companies need to expand their business success metrics beyond the bottom line and recognise the long-term value sustainability creates. The CO2X platform is the best starting point for companies keen to embark on their sustainability journey. Our inclusive platform will lower the barriers for SMEs to incorporate sustainability practices and bridge the gap between businesses and financial services in a data-driven approach.”

Mr Peter Ho, President of CDAS, and the CEO of Wing Seng Logistics Pte Ltd, commented:

“CDAS is proud to be supporting Singapore’s Green Plan roadmap to reduce carbon emissions in the industry, and will support efforts to reduce its carbon footprint through automation, digitalisation, smart technology, as well as exploration of alternative fuels. Just as we have done so before, through our various industry digitalization and automation solutions, we can work together as an industry, and as one united nation, towards a brighter, greener, and cleaner future for our children.”

Mr Oh Bee Lock, CEO of Singapore Logistics Association (SLA), commented:

“As the global economy emerges from battling the Covid-19 pandemic, governments and businesses are shifting gears to be more environmentally responsible. This transition to decarbonisation will also reconfigure the way global supply chains are organised and executed. Logistics service providers therefore have to stay up-to-date on climate policies and develop capabilities to comply with new sustainability measurements and emission reduction. As such, the Singapore Logistics Association has started a series of events to help our members keep abreast of sustainability trends, best practices and policies, with the aim of capturing business opportunities with greener logistics solutions and new innovations. One such example is the CO2X platform, that demonstrates how digital technologies will be able to help track and manage carbon emissions in the very near future.”

Mr Ricky Loo, CEO of CWT Integrated, shared:

“Sustainable development strategies are a priority for many companies. At CWT, we embed ESG and technology in the company to optimise operating and cost efficiency, reduce carbon footprint and create a great workplace culture while ensuring effective corporate governance. By taking responsibility for changing the way we operate, we benefit the environment, help customers succeed and communities thrive.”

Ms Pearlyn Phau, Group CEO, Aviva Singlife, shared:

“Sustainability is one of the core pillars of our business strategy. Aviva Singlife is pleased to be the first insurer to work with CO2X to utilize their Blockchain technology to underwrite and find green insurance solutions for the Transport and Logistics sector. Customers can leverage the platform to track their carbon footprint for benchmarking, devise fuel reduction strategies, reduce fuel costs and reduce emissions. By analysing the data collected, Aviva Singlife will be able to better assess and provide reduced insurance premiums for logistics operators. This is a win-win solution that will support sustainability in business.”

Mr Linus Goh, Head of Global Commercial Banking, OCBC, shared:

“The case for going green today is becoming clearer for businesses across all industries and regions, but for real change to take place, SMEs need to have practical ways to measure and monitor their carbon footprint. We at OCBC are happy to partner with CO2X as it sets out to address this gap across a broad range of industries. We believe technology solutions like this will combine well with our green and sustainability-linked loans to help our SME customers across the region to successfully transition their businesses and projects.

Mr Bonar Silalahi, Managing Director, Head of Consumer Goods and Industrials, Group Wholesale Banking, UOB, shared:

“UOB’s approach to sustainability is to simplify the adoption of sustainability practices for business. The tools and tracking systems that CO2X offers can help fleet operators reduce their carbon emissions. This collaboration enhances UOB’s capabilities and provides our customers with an integrated end-to-end approach as they embark on their sustainability journey and grow responsibly while reaping the long-term benefits of going green. To support our customers’ switch to electric vehicles, UOB recently launched U-Drive, a comprehensive electric vehicle financing solution for fleet operators. Through our sustainable financing initiatives and solutions, we hope to quicken the transition to a lower carbon economy and are committed to supporting Singapore’s 2030 vision.”

1 The programme aims to groom future global champions who can contribute significantly to Singapore’s economy and create good jobs for Singaporeans.

2 https://www.nccs.gov.sg/singapores-climate-action/singapore-emissions-profile/

– End –

About CO2X Pte Ltd (“CO2X”)

CO2X is founded by 3 innovative multi-award-winning Singapore-based companies with a shared passion for technology for sustainability. By merging our proven expertise in the IoT, Data Analytics and Blockchain space, we bring ready solutions to address real world challenges within the sustainability space. CO2X aims to be the world’s most inclusive sustainability platform where businesses, technology and finance meet to drive sustainable change, accelerating the adoption of data-driven sustainability solutions across businesses of all sizes, across all sectors.

Learn more about CO2X and register your interest: www.co2connect.com

For media queries please contact: Sheena Ang Ezzati Azmi, Business Development Manager |

Annex A – About the CO2X Solution

CO2X automates the entire process through cutting edge IoT, blockchain and data analytics technologies. It will be an inclusive one-stop platform backed by industry standards, making it simple and accessible to all companies, regardless of size.

CO2X will help companies in three key areas:

· Quantification

Data quantified through IoT and analysed through data analytics, will be converted into carbon emission data. Based on the data, CO2X will provide suggestions for fuel/carbon emission reduction.

· Accreditation

Reports generated will undergo green accreditation according to different sustainability standards. CO2X will issue its own Carbon Avoidance Certificate (CAC) that is recorded on an immutable blockchain.

· Monetisation

Boosted investor confidence due to trustable and accurate impact reports and carbon emission computations will enable corporates, especially small and medium enterprises, to attain better sustainable finance (e.g. better loan rates, more attractive insurance premiums, etc.).

Furthermore, companies will eventually be able to monetise their carbon emissions reduction journey by generating, or converting CACs into, quality carbon credits as tradable Non-Fungible Tokens (NFTs) on the blockchain.

Worries of greenwashing by Financial Institutions are kept at bay with greater transparency and traceability during audits and appraisals. Financial Services are able validate real-time data and projects to defray the risk when making green investments and loans. Hence, empowering them to make more informed and accurate assessments and mobilise capital within Environmental, Social and Governance (ESG) space.

CO2X platform is able to take away the complexity and build trust between businesses and financial institutions.

Annex B – About the Founder Companies

About Ascent Solutions Pte Ltd (“Ascent”)

Ascent Solutions is a Singapore-based company specialising in industrial IoT solutions for the Logistics/Supply Chain, Infrastructure and Trade Finance verticals. Established in 2010, Ascent’s founders are global technology executives with more than 20 years of proven track records in technology entrepreneurial endeavours. Ascent works with both private and public clients in various industries, providing consultancy, design, development and the deployment of end-to-end industrial IoT solutions, and is currently a Scale-up SG programme participant.

About Evercomm Singapore Pte Ltd (“Evercomm”)

Evercomm is a company that focuses on providing AI-driven Asset Performance Management (APM) solutions for energy-intensive enterprises. The company provides a holistic energy management approach combining energy supply and demand, decarbonisation services, environmental risks compliance reporting and management. Evercomm is participating in Enterprise Singapore’s Scale-up programme, and is also a Singapore Digital (SG:D) Accredited company. It works closely with the United Nations and various governments around the world to pilot industry-scale sustainability transformation initiatives.

About Hashstacs Pte Ltd (“STACS”)

STACS is a Singapore FinTech company providing Transformative Technology for the Financial Industry, with its live blockchain infrastructure that unlocks value and enables effective Sustainable financing. Its clients and partners include global banks, national stock exchanges, and asset managers. STACS is The Asset Triple A Digital Awards 2021 FinTech Start-Up of the Year, an Award Winner of the Monetary Authority of Singapore (MAS) Global FinTech Innovation Challenge Awards 2020, and also a two-times awardee of the Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant, under the Financial Sector Development Fund administered by MAS.